2021 1099s & W-2 Deadlines

To process your required 1099s and W-2s in a timely manner, we are requesting your information be submitted to Lewis & Knopf no later than January 22.

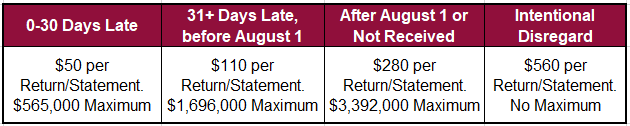

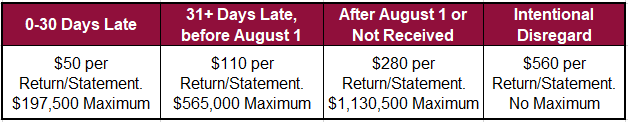

We have listed the penalty amounts for late filings per the 2020 tax year instructions by the IRS.

Large Businesses with Gross Receipts of More Than $5 Million

(Average annual gross receipts for the most recent 3 taxable years) and Government Entities (Other than Federal entities) IRC 6721 & IRC 6722

Small Businesses with Gross Receipts $5 Million or Less

(Average annual gross receipts for the most recent 3 taxable years)

IRC 6721 & IRC 6722

If you need help sending your files to your Lewis & Knopf advisor, please contact our Portal Administrator, Vicki Mullin, at vmullin@lewis-knopf.com.