IRS Releases New Projected 2019 Tax Rates, Brackets and More

Bloomberg recently released projected tax rates, brackets and other numbers that apply to the 2019 tax year (the IRS will release the official numbers later this year). Note, these are NOT the numbers that apply to the 2018 taxes you file in 2019, but to the income and activity that occurs during the 2019 tax year that starts January 1, 2019.

A big part of the IRS’s consideration in formulating 2019 numbers is the inflation index. The Tax Cuts and Jobs Act (TCJA) replaced the normal Consumer Price Index with chained CPI. Chained CPI doesn’t simply measure the change in prices. Rather, it measures consumer responses to high prices, effectively creating a smaller inflation adjustment. In any case, inflation adjustments are a critical component (and often the main driver) in year-to-year tax bracket, exemptions and eligibility thresholds.

With an understanding of what underpins the 2019 adjustments (in addition to the impact of the new tax legislation), let’s look at the changes.

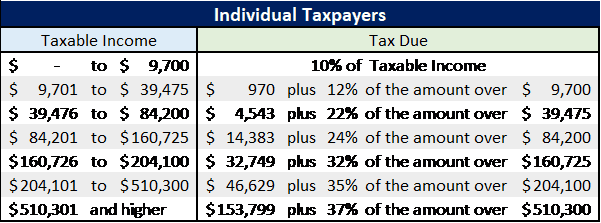

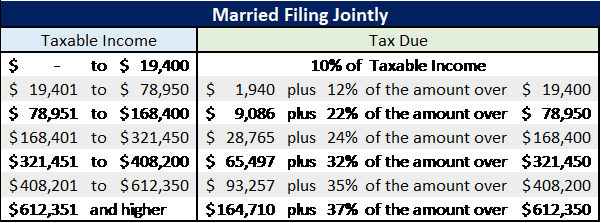

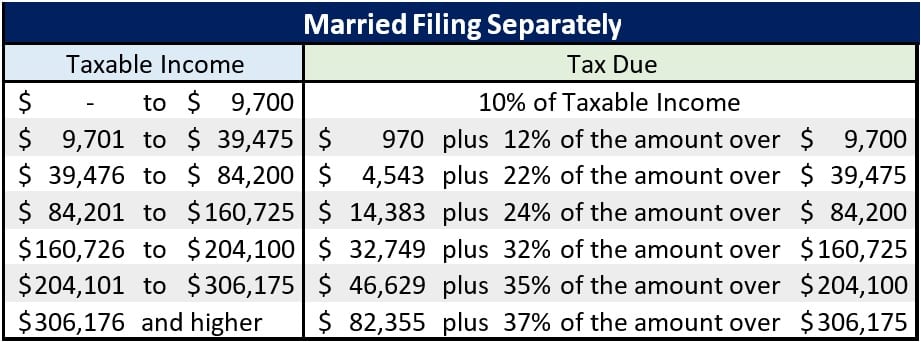

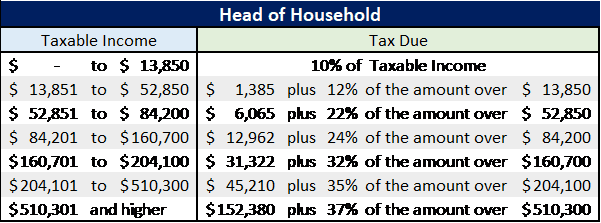

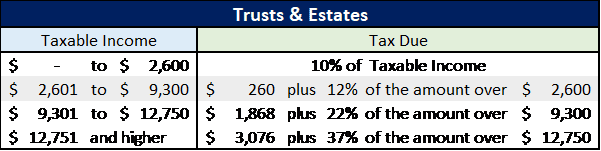

Tax Brackets

The increasing CPI means brackets are being pushed upward – albeit slightly – giving us these projected tax brackets for 2019.

Personal Exemption Amounts

Personal exemptions are eliminated under the TCJA, so there is no adjustment any longer. The deduction for a qualifying relative is a similar type of item to the personal exemptions and is expected to be between $4,150 and $4,200 for 2019.

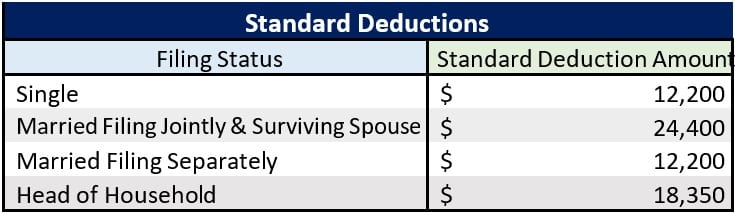

Standard Deduction

In combination with eliminating personal exemptions, the TCJA approximately doubled the standard deduction for most taxpayers in 2018. With inflation figures where they currently stand, projections are as follows for 2019:

Certain taxpayers receive additional standard deductions; for example, deductions for the elderly (65 or older) or the blind will be $1,300 in 2019 for married filing jointly and $1,650 if neither married nor a surviving spouse.

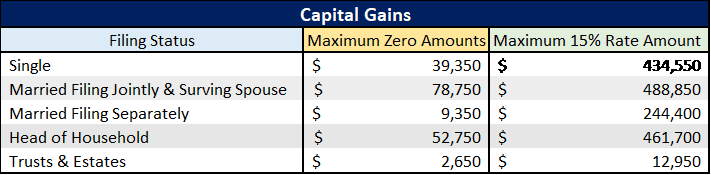

Capital Gains

There is no change in capital gains rates for 2019; break points between brackets do change, with the maximum 0 percent and 15 percent rate amounts as follows:

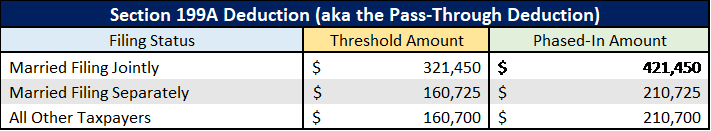

Section 199A Deduction (aka the Pass-Through Deduction)

Under the TCJA, sole proprietors and owners of pass-through entities are allowed up to a 20 percent deduction on qualified business income. To qualify for the deduction, a certain threshold must be met, and phased-in limitations are applicable. They are projected to be as follows for 2019:

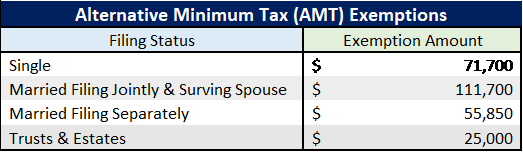

Alternative Minimum Tax (AMT)

AMT exemptions are also subject to adjustment for inflation and are projected to be as follows:

Don’t forget, these are only projected changes. The IRS will release the official numbers later this year. Contact your Lewis & Knopf tax advisor for further guidance on your situation.