Financial Perspective

The insurance industry has a lagging relationship with the overall economy, feeling stresses in its business some six to twelve months after a recession or recovery kicks in. In a recession, tighter operating environments result in reduced premiums and the tougher business climate produces higher rates of default, financial strain and losses from those firms that are insured.

Lagging the economy hasn’t historically helped the insurers avoid problems, however. Insurers may be able to see tough times from a recession coming like a train wreck further ahead on the track but they aren’t always able to get off the wrong train in time. Part of what makes market decisions difficult for insurance companies is that their losses can be so dramatically influenced by catastrophes, natural or otherwise. Disasters are impossible to forecast actuarially and the severity can wreak havoc with insurance industry plans.

Insurers were devastated by claims related to the terrorist attacks of September 11, 2001, which came as the more predictable losses were mounting from the recessionary business cycle that had begun when the tech bubble burst eighteen months earlier. By the same token the steep losses brought on by Hurricanes Katrina and Rita hit the industry as its recovery was gathering momentum in 2005. As the general economy cratered in 2009 and business losses continued into 2010, most industry observers were predicting a “hard market” for insurance, one where growing losses would dictate rising premiums and more difficult conditions for the insured; however, catastrophic losses have been less severe during the downturn and early stages of recovery, leaving insurance executives scratching their heads about the hard market.

“I thought conditions would get tighter. Rates were going higher two years ago but with the economy so slow the market never got harder,” says Nick Tropiano, owner of Assured Risk Advisors. “We kept hearing that once insured losses hit $60 or $70 billion things would change, but even with the disaster in Japan the casualty market isn’t going to change much any time soon.”

Marty Muchnok, from First Niagara Risk says it has been eight years or so since the last true hard market, but believes the insurance companies are starting to respond because of the catastrophic losses. “We are starting to see a firming of the market,” he says. “Underwriters are starting to tell us that they are being directed to get five percent increases, although no one wants to lose the account over that. This has been coming from the big insurers – Travelers, Chubb, Firemans – and even the regional carriers who usually lag the market are doing it.”

Softer or harder conditions in the property and casualty or general liability markets have had a significant effect on the surety market conditions during the last few business cycles. As insurance premiums decline overall, companies look to profitable lines – like surety – to get increased revenue. This was especially true in the early years of the last decade when there was something of a perfect storm of excess competition, deteriorating construction market conditions and accelerating losses as the insurers looked to surety operations to grow their market share aggressively, even though the size of the surety market – usually around $5 billion – was too small to materially improve the insurance companies’ bottom line.

What occurred during that recession in 2000-2002 was somewhat counterintuitive to most in the construction industry, who would expect recessions to make surety companies tighten bonding, but the drive to grab new customers pushed insurers to offer more capacity to contractors with less than sufficient regard for their financial condition. This resulted in higher premium revenues for those sureties but the resultant losses more than offset them. In the fallout, surety losses climbed as high as 83% of the premiums earned. Those that overstepped the market failed and a number of insurers walked away from the surety business as the economy recovered. This business cycle it appears that the lessons of that period may have finally been learned.

“We run our business in separate silos and our end is running about the same as always,” says Liberty Insurance’s bond manager Chris Pavone. “I’ve only been with Liberty for eight years but the underwriting standards haven’t changed. All I’ve heard here is bottom line, bottom line, rather than sales volume or getting more business.”

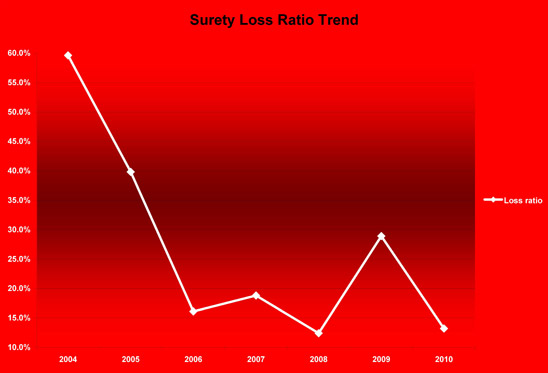

Pavone’s characterization of his company’s business focus seems to be more commonplace in this market, at least if the reports from the National Association of Surety Bond Producers (NASBP) annual conference in May are any indication. Surety loss ratios were 13.2% for last year, the second lowest in more than a decade, and companies were comfortably profitable.

“At the NASBP conference at the Broadmoor in Colorado Springs there wasn’t a lot of complaining about 2010,” says Jay Black, managing partner of Seubert & Associates surety division. “Everyone enjoyed a decent year but they were seeing an uptick in payment bond claims that the construction economy is driving.”

Marsh’s managing director for its construction practice, Jim Bly agrees with Black’s take on the most recent year. “There were no major surprises in the financial performance,” he says. “Most companies planned for the downturn well. Surety company losses were well below 20 percent so they are very healthy coming into 2011. But most also expect to experience challenges this year.”

Bly explains that loss of contracting volume is the culprit for the declining expectations rather than their customers’ profit erosion during the job. And he says that two years of competing for work with shrinking margins is starting to take its toll.

“We’re seeing a lot more red ink from our clients when we’re reviewing 2010,” he says. “Up to 20 percent of contractors or subcontractors are losing money. That’s not just us but also the surety companies we handle. Compared to what we saw in 2008 – maybe 2 percent losing money – that’s a big change.”

Those deteriorating financials for the contracting side of the business are why those in the surety industry are looking past the recent years’ performance and focusing on the potential for negative performance in 2011. Aside from the tendency in human nature to focus on the dark cloud instead of the silver lining, the caution also comes from past experience with an extended period of slower construction. Much like what has happened in the financial markets – where credit tightening occurred well after it was needed and for too long into a recovery period – the surety companies will generally need to respond to poorer client financials by increasing scrutiny and reducing contractor bonding programs, perhaps just as the market is beginning to see signs of construction activity picking up. It will be easy to blame the insurers for tightening their standards at the wrong time but timing a response to recession is virtually impossible.

What surety customers can expect in 2011 is pretty typical for the early phase of recovery: more frequent reviews; more questions; stricter adherence to ratios and financial reporting; constraints on bonding limits being discussed and implemented in worse cases. None of these measures are particularly popular with contractors – or with surety agents for that matter – but the discomfort extends past the sureties and their clients. It’s important for owners and architects to remember that tighter bonding conditions can limit the response to their projects as well.

On the upside at the moment is the fact that market conditions favor the surety companies’ remaining conservative about their approach to the markets. One motivator that can spur competition and looser underwriting is an aggressive company viewing the soft market as an opportunity to make real inroads in market share by extending capacity to grab new clients. This is akin to offering more credit to someone dangerously in debt. In many past markets the urge to gain share was fueled by the residual earnings that insurers could get from investing the premiums from their newfound customers. Those investment markets aren’t very alluring at the moment.

“What’s also interesting about the market now is how limited the investment opportunities are,” says Pavone. “There’s always talk about how much money insurance companies make with investments but with rates where they are now there isn’t a lot of money to be made. Back in the day someone may have been more aggressive about getting cash in because you could make money to offset additional risks with the investments. That’s not really possible now.”

Most surety bond managers are less concerned about the potential weakness among insurers than they are about the weakness in the construction market, at least for the near term.

“There are a couple of things that can be very dangerous for contractors when the market is like this for a few years,” explains Jay Black. “Cash flow is critical and if a company has been robbing Peter to pay Paul from one job to another they won’t be able to sustain that when there’s an extended lull like we’ve had.”

Black also pointed to the recent spate of projects being delayed or shelved after bidding as a troubling symptom of owners’ uncertainty. “There have been some big schools and prisons where contractors have been identified as the low bidder and then the owner pulled the plug,” he says. “One of the most dangerous things for contractors is when they are the low bidder on a big job or two because they slow down on estimating actively and don’t pursue other jobs. If they are low on a big job they may not chase another one they really wanted or had been following. When the job they had is cancelled there is no chance to go back and get the other one.”

Jim Bly is still concerned about the volume of projects, particularly for infrastructure contractors. “I just don’t see the availability of work improving this year. That’s especially a problem for the middle of the market,” he says. “There isn’t the high volume of $10 million to $30 million jobs and the heavy and highway market is way off. PennDOT may be alright but the Turnpike has nothing to bid on its website right now.”

While the insurance industry lags the market overall, surety business usually gets a whiff of a change in advance because their customers are calling them about more project bonds ahead of the contracting. The current caution may only reflect a shift away from public to private projects, especially since the emerging industries in the regional economy tend to hire contractors without requiring bonding, but the concerns may also be a harbinger of a slower summer.

For the time being the surety business is looking at 2011 quite tentatively and watching the mid-year financial reports for signals about direction.

Chris Pavone expects that problems should arise from the market but hasn’t seen those expectations met yet. “We kept waiting for financial statements to look really bad and then for claims to jump way up but even through 2010 that hasn’t been happening yet.”

“A lot of experts expect things to firm up later this year but I’ll believe it when I see it,” notes Nick Tropiano. “When January 1 comes and the big companies have to renew with the reinsurers we’ll see if that changes rates.”

Marty Muchnok agrees with that timeline. “What happened in Japan and what has been happening all over the U. S. for the last six months – the floods, tornadoes – will have an effect on reinsurance, which will put pressure on the whole insurance market,” he says. “I expect that we’ll see that in the market after January 1, but I don’t think it will be as dramatic as in past, when customers got increases of 20 percent or more.”

In the mean time, expect caution to rule the day. Owners should not be surprised to see bonding costs rise and contractors’ capacity become limited. Market conditions like these can tempt anxious owners and developers to reduce or forego bonding requirements. Experience suggests the opposite would be a safer choice.

Loss ratios for the surety companies continued to bounce around near record lows since 2008. Source NASBP.

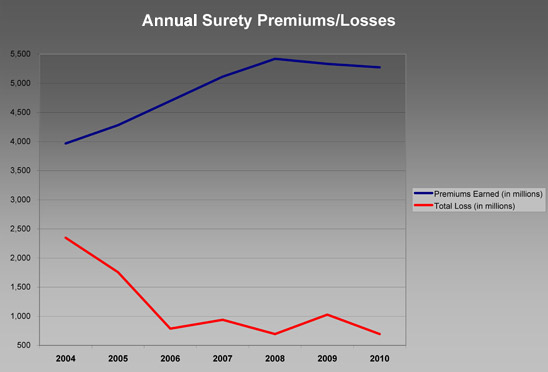

The spread between earned premiums and insured losses for the largest 100 surety companies widened in 2010, a market condition that has often preceded sharp changes in fortune. Source NASBP.